At its heart, the Net Promoter Score (NPS) is beautifully simple. It all boils down to one powerful question you ask your customers: “How likely are you to recommend our [company/product] to a friend or colleague?” That’s it. Based on a simple 0-10 scale, this single query gives you a surprisingly clear snapshot of how people really feel about you.

Decoding the Net Promoter Score Question

Think of the NPS question as a quick, universal health check for your business. Instead of bogging customers down with a long, complicated survey, it delivers a fast, standardised metric that’s dead simple to understand and track over time. The beauty is in that simplicity—it cuts through the noise and lets you benchmark your performance against competitors or even just your own past results.

The whole idea is that a customer’s willingness to put their own reputation on the line and recommend you is the purest signal of their loyalty. A high score? You’ve got a healthy, happy relationship. A low one? It’s a clear warning that something’s not right and needs a closer look.

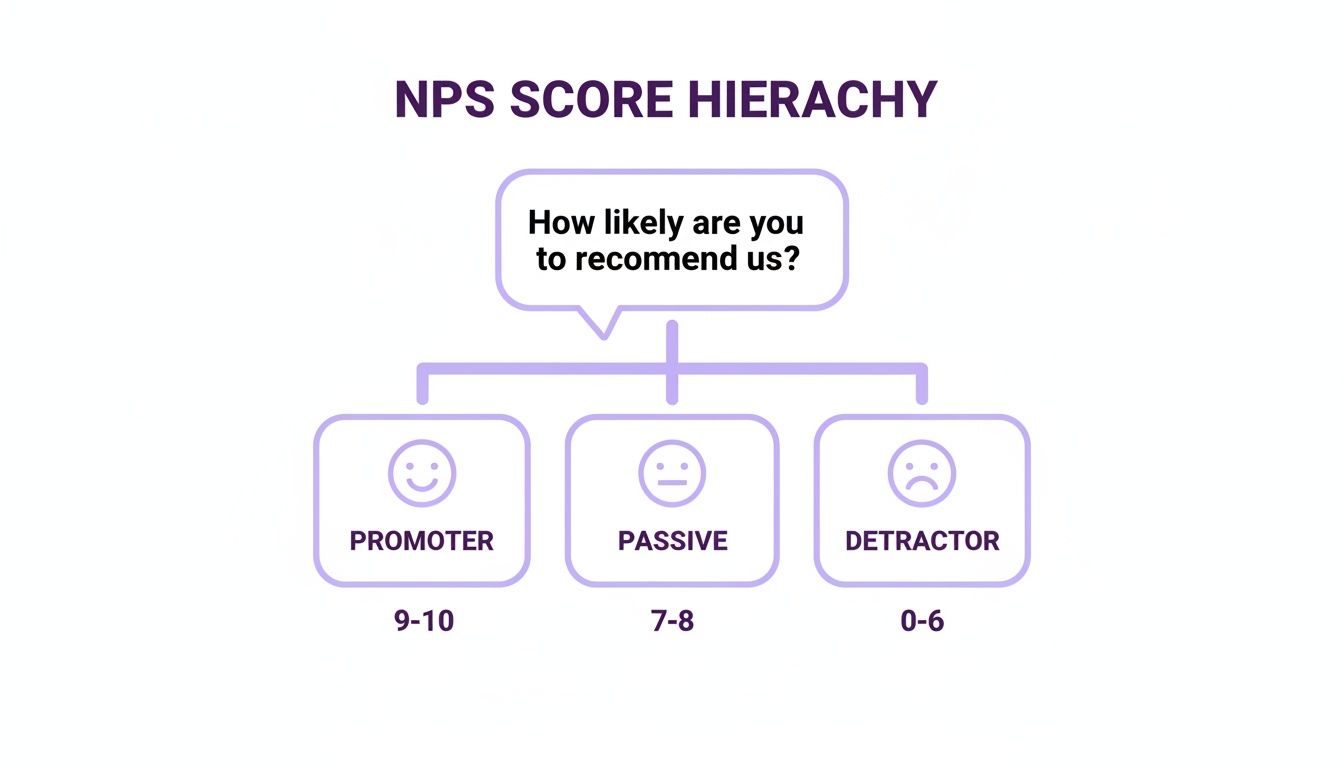

The Three Customer Segments

The responses to the standard NPS question format neatly sort your customers into three distinct groups. Each one tells a different story about their loyalty and what they might do next. Getting to know these segments is the first real step in turning raw feedback into meaningful action.

Here’s a quick rundown to get you started on understanding these crucial customer groups.

NPS Customer Segments at a Glance

| Customer Segment | Score Range | Typical Sentiment and Behavior |

|---|---|---|

| Promoters | 9–10 | Your biggest fans. These are the loyal, enthusiastic customers who act as your brand advocates, fuelling growth with word-of-mouth. |

| Passives | 7–8 | They’re satisfied but not thrilled. Passives are neutral and can easily be tempted by a competitor’s offer. |

| Detractors | 0–6 | Unhappy customers. They’re at risk of churning and can actively damage your brand with negative reviews and feedback. |

This breakdown makes it clear: Promoters are your growth engine, Passives are on the fence, and Detractors can put a real dent in your reputation. It’s that simple.

This graphic drives the point home. Your Promoters are the ones pushing you forward, while Detractors can actively hold you back.

To get your final NPS score, you just subtract the percentage of Detractors from the percentage of Promoters. This simple formula gives you one powerful number that sums up your overall customer loyalty. Easy.

While NPS is fantastic for capturing direct feedback, it’s also smart to keep an eye on the bigger picture. A solid reputation monitoring service can help you understand how your brand is being talked about all over the web, giving you a complete view of your public perception.

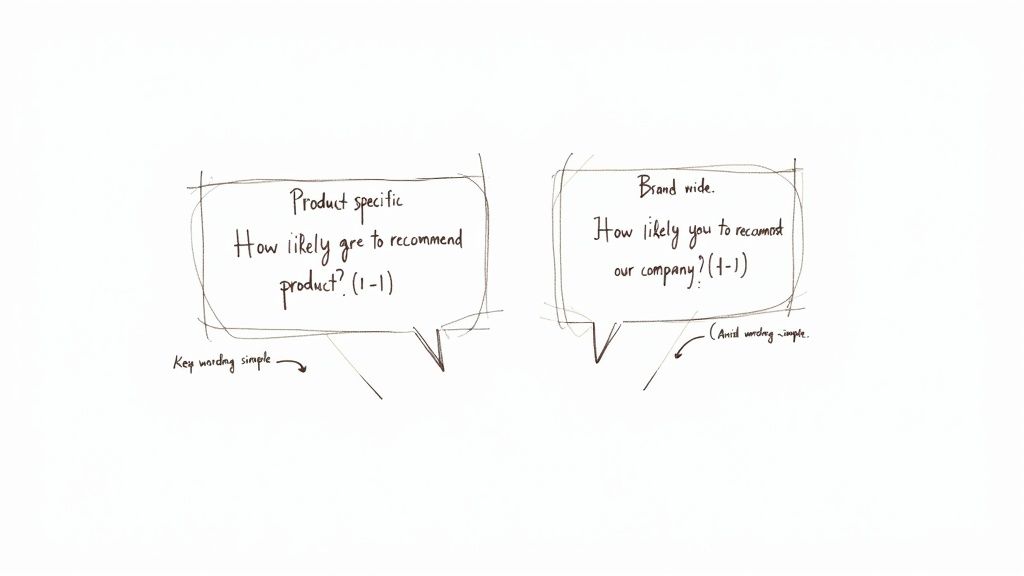

How to Phrase Your NPS Question for Maximum Insight

While the Net Promoter Score system is built around one standardised question, the way you word it can make a world of difference to the clarity and quality of your results.

Think of the core question as a sturdy chassis; you can add different bodywork depending on the journey you want to take your customer on. The key is to make subtle adjustments for context without breaking the underlying mechanics.

The classic NPS question format is intentionally broad: “How likely are you to recommend [Company] to a friend or colleague?” This works perfectly for measuring overall brand loyalty. But sometimes, that general approach won’t give you the specific feedback you need after a customer interacts with just one part of your business.

Brand vs. Product Specific Phrasing

One of the most common and effective tweaks is simply specifying what you want feedback on. It seems like a small change, but it focuses the customer’s mind on a particular experience, giving you much more targeted insights.

-

Brand-Level (Relational): “How likely are you to recommend HappyPanda to another SaaS founder?”

- When to Use It: This is your go-to for quarterly check-ins or annual surveys to gauge overall brand health and the strength of your customer relationships.

-

Product-Level (Transactional): “Based on your recent setup experience, how likely are you to recommend our Onboarding Checklists to a friend?”

- When to Use It: Perfect for triggering right after a specific interaction, like completing an onboarding flow, trying a new feature, or getting help from support.

This distinction is crucial. Asking about the brand right after a frustrating product experience might net you a low score, but you won’t know exactly what caused it. On the flip side, asking about a specific feature tells you precisely where you need to direct your improvement efforts.

A common mistake is using internal jargon or overly formal language. Always phrase the question using simple, clear words your customers would use themselves. If a user has to guess what you mean, the data is already compromised.

Common Phrasing Mistakes to Avoid

Getting the wording just right ensures you don’t accidentally confuse or lead your respondents. For example, if you’re sending surveys via mobile, clarity is king. It’s wise to follow established SMS marketing best practices to make sure your question lands with impact in a tight format.

Here are a few pitfalls to sidestep:

- Being Too Vague: Avoid questions like, “How did we do?” This isn’t an NPS question and completely misses the crucial 0-10 “likelihood to recommend” scale.

- Combining Questions: Never ask, “How would you rate our service and the new user interface?” This forces the user to mentally average two completely different experiences.

- Leading the Witness: Phrasing like, “Now that you’ve seen our great new feature, how likely are you to recommend it?” can easily bias the response.

By keeping your NPS question format clean, specific, and neutral, you’ll gather reliable data you can act on with confidence. For more guidance on creating effective surveys, check out our detailed guide on building high-converting customer feedback forms to ensure you’re getting the most out of every interaction.

Why Your NPS Follow-up Question Is a Goldmine

The standard NPS question format is brilliant for capturing a single, powerful metric. It tells you what your customers think. But the real treasure lies in understanding why they gave you that score. This is where the open-ended follow-up question transforms a simple number into a genuine roadmap for improvement.

Think of your NPS score as a weather report; it tells you if it’s sunny or stormy. The follow-up question is the detailed forecast explaining the atmospheric pressure, wind direction, and humidity. It shows you exactly what’s causing the weather. Without it, you’re just guessing.

This qualitative feedback is pure gold. It pinpoints the specific pain points from your Detractors, highlights what Passives feel is just “meh,” and uncovers the “wow” moments that create your Promoters. This is the stuff that helps you prioritise your product roadmap, squash frustrating bugs, and double down on what people love.

Tailoring Questions for Each Segment

A one-size-fits-all follow-up question is a massive missed opportunity. To get the most valuable insights, you need to ask a slightly different question based on the score someone just gave you. The goal is different for each group: learn from Detractors, persuade Passives, and mobilise Promoters.

Here are a few simple, proven templates you can adapt:

-

For Detractors (0-6): Your mission is to find the root of the problem.

- “What is the primary reason for your score?”

- “What was missing or disappointing in your experience with us?”

- “What’s the one thing we could do to have made your experience better?”

-

For Passives (7-8): You need to uncover what’s holding them back from becoming true fans.

- “What could we do to improve your score from a 7 to a 10?”

- “What would make you love our product, not just like it?”

-

For Promoters (9-10): Figure out what you’re doing right so you can do more of it.

- “What was the best part of your experience with us?”

- “We’re so happy you’d recommend us! Could you tell us why?”

This segmented approach ensures you’re asking the most relevant question at the perfect time. It shows customers you’re actually listening and gives your team neatly categorised, high-quality feedback to work with.

Remember, the key is to keep the follow-up question simple and open-ended. Avoid leading questions or multiple-choice options, as they completely kill the richness of the response you’re trying to get.

The insights you gather are just the first step. Responding to that feedback is equally critical. Learning how to act on this data is essential for customer retention, which is why closing the feedback loop with your users is a non-negotiable part of any successful NPS programme. Acting on feedback shows customers their opinion truly matters.

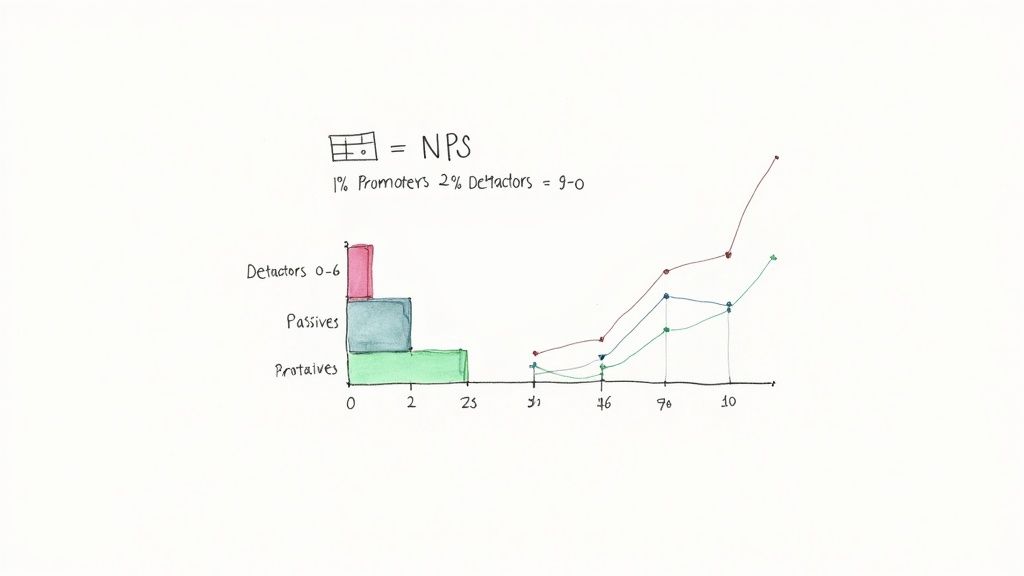

Calculating and Making Sense of Your NPS Score

Alright, you’ve gathered your responses using the classic NPS question format. Now comes the fun part: turning all that raw data into a single, punchy metric. Calculating your Net Promoter Score is surprisingly simple, and it gives you a clear benchmark for just how loyal your customers are feeling.

The formula is a breeze: you just subtract the percentage of Detractors from the percentage of Promoters. The Passives? We ignore them in the final calculation, as they’re sitting on the fence.

(% Promoters) – (% Detractors) = Your NPS Score

This little bit of maths gives you a score that can land anywhere between -100 (if every single person is a Detractor) and a perfect +100 (if everyone’s a Promoter).

A Simple Calculation Example

Let’s say you sent out a survey and got exactly 100 responses back. This makes the maths dead easy.

Here’s how your responses break down:

- 60 Promoters (scores of 9-10) = 60%

- 25 Passives (scores of 7-8) = 25%

- 15 Detractors (scores of 0-6) = 15%

Now, just pop those percentages into the formula: 60% (Promoters) - 15% (Detractors) = +45

Your NPS score is +45. That’s it. Remember, it’s not a percentage—it’s a whole number.

What Your Score Actually Means

A single NPS score is a useful snapshot, but its real power comes from context and trends. A score of +45 might sound decent, but is it actually any good? The answer really depends on your industry and, more importantly, how you were doing last quarter.

While NPS and CSAT are different beasts, understanding how they work together can give you a much richer view. You can learn more about the differences between CSAT and NPS in our detailed guide.

The most valuable comparison for your NPS score is your own score from the previous quarter. A rising score tells you customer loyalty is improving, while a falling score is an early warning sign that something needs your attention—fast.

Honestly, focusing on the trend over time is far more insightful than obsessing over a single number. This approach turns NPS from a static grade into a dynamic tool for tracking the health of your customer relationships and making smart decisions that actually drive growth.

Putting NPS to Work in Southeast Asian Markets

Let’s be honest, in Southeast Asia’s buzzing digital markets, just slapping a standard nps question format onto your website isn’t enough. With e-commerce and fintech growing at lightning speed, you need a smarter approach. It’s time to move beyond simply measuring loyalty and start actively using it as a secret weapon for growth.

The whole game boils down to timing and context. It’s all about choosing the perfect moment to ask for feedback so you get insights that are actually useful.

Transactional vs. Relational Surveys

So, when is the right time to ask? It really depends on what you’re trying to figure out. You’ve got two main flavours of NPS surveys, and both have their place.

-

Transactional NPS: Think of this as an instant reaction. You trigger this survey right after a specific interaction happens. A customer just finished a purchase? Boom, send an NPS survey the next day. They just completed onboarding or had a chat with your support team? Perfect timing. This gives you laser-focused feedback on that one single touchpoint.

-

Relational NPS: This one is more of a long-term health check for your customer relationship. You send it out at regular intervals—maybe quarterly or twice a year—to get a feel for how customers view your brand as a whole. It helps you spot trends and see if your overall loyalty is heading in the right direction.

For any digital-first business trying to stand out in this ridiculously competitive region, mixing both types is the key. It gives you the full story of your customer experience, from the tiny details to the big picture.

Turning Data into a Competitive Edge

In markets overflowing with customer choice, loyalty is your lifeline. That NPS score isn’t just a number to report in a meeting; it’s a direct line into your customers’ heads, telling you what keeps them around and turns them into fans. You can use this feedback to personalise experiences and build loyalty programmes that actually stick.

For example, when a customer drops a Promoter score, that’s your cue. It’s the perfect moment to invite them to a rewards programme or ask for a glowing testimonial. On the flip side, a Detractor score should sound the alarm, triggering an automated follow-up from your support team to jump on the issue and turn a bad experience into a great one.

The Net Promoter Score (NPS) question format is a simple, standardised way to check the pulse of customer loyalty. It asks one simple question on a 0-10 scale, and research in Southeast Asia confirms a powerful link between this score and what customers actually do next.

One report found that loyalty programmes tied directly to NPS measurement seriously boosted word-of-mouth marketing. Customers in these programmes were 1.5 times more likely to be Promoters and a whopping 45% more likely to recommend the brand. You can discover more about how loyalty programmes impact NPS scores and fuel growth. By systematically using the nps question format, you’re not just collecting data—you’re building a real competitive advantage.

How Southeast Asian Businesses Are Winning with NPS

The real magic of the standard NPS question format isn’t just about measurement; it’s about driving actual business results. In the fast-moving markets of Southeast Asia, companies are showing how tracking this one little metric can forge stronger customer relationships and sharpen their operations. It’s about turning simple feedback into a strategic superpower.

When you use it consistently, NPS stops being just a score and starts becoming a catalyst for genuine change. By linking feedback directly to different parts of the business—from the support desk to the product team—you can make smarter decisions that build loyalty and, ultimately, boost your bottom line. The beauty of its standardised format is that it gives you a clear, consistent benchmark to track your progress over time.

From Score to Strategy in Action

For companies in high-stakes industries like logistics and financial services, customer trust is the whole game. A rising NPS trend isn’t a vanity metric; it’s a direct signal of your company’s health and your customers’ loyalty. It proves that the changes you’re making, based on their previous feedback, are actually working. It’s a classic win-win.

This is especially critical where the competition is fierce and one bad experience can send a customer running to a rival. By digging into the “why” behind their scores, these businesses can iron out friction points, double down on the things customers rave about, and show a commitment to service that builds the kind of trust that lasts.

The consistent application of the NPS question format provides more than just a score; it delivers a clear, quantifiable narrative of customer loyalty over time, directly linking feedback initiatives to positive business outcomes.

A Real-World Example from Logistics

A fantastic example of the NPS question format in action comes straight from the logistics sector. The 2025 GEODIS customer survey, which connected with over 60,000 customers worldwide including Southeast Asia, tells the story perfectly.

They saw their Net Promoter Score jump from +36 to +39, fueled by a record 15% response rate. This wasn’t just a random fluctuation; they tied it directly to higher satisfaction in their commercial relationships (94%) and a better track record of resolving issues efficiently. You can dig into their customer satisfaction survey findings to see the full picture. It’s a clear demonstration of how tracking NPS isn’t just about collecting data—it’s about proving your customer-first efforts are truly paying off.

Common Questions About the NPS Question Format

Alright, let’s get into the nitty-gritty. Once you decide to run with NPS, a few practical questions always seem to pop up. Nailing these details is the difference between a feedback programme that just collects dust and one that actually gives you clear, actionable insights.

Let’s tackle some of the most common ones we hear.

How Often Should I Send an NPS Survey?

The perfect timing really depends on what you’re selling. If you’re in e-commerce, it makes sense to send a survey a few days after a customer makes a purchase—that’s a transactional approach. But for a subscription or SaaS model, you’re playing the long game. A relational approach works best here, so think about surveying customers quarterly or even semi-annually to get a feel for their overall loyalty.

As a general rule of thumb, try to avoid hitting up the same customer more than once every 90 days. You don’t want to cause survey fatigue. Respecting their time means you’ll get much better responses when you do ask.

Can I Customise the Wording of the NPS Question?

Absolutely. Minor tweaks are not only fine but often a good idea. Feel free to swap out “[Company Name]” for “[Product Name]” or even a specific feature if you want to get more targeted feedback.

The key is to keep the core structure untouched. The magic lies in the phrase “How likely are you to recommend…” paired with the standard 0-10 scale. If you start messing with that fundamental phrasing, you lose the ability to benchmark your score against industry standards. More importantly, you won’t be able to track your own progress accurately over time, and that’s a rookie mistake.

What Is a Good NPS Response Rate?

This one varies wildly, so don’t get too hung up on a magic number. Your industry, the channel you use (email vs. in-app), and how much your customers actually like you all play a part. For email surveys, anything between 5% and 15% is generally considered pretty solid.

In-app surveys, on the other hand, almost always knock it out of the park. They can easily hit 25-30% or even higher because they catch people at just the right moment. The best strategy? Forget everyone else for a minute and just focus on improving your own rate over time by tweaking your timing and messaging.

Ready to put all this into action? HappyPanda pulls all your customer feedback tools—NPS, CSAT, onboarding checklists, and email sequences—into one simple platform built for SaaS founders. Start collecting valuable feedback in minutes.