When customers cancel their subscriptions, that’s SaaS churn. It’s the single biggest obstacle standing between your subscription business and sustainable growth, and it directly hits your profitability, ability to scale, and even investor confidence.

Why Churn in SaaS Is the Silent Growth Killer

Imagine your business is a bucket. Every new customer you sign up is water you’re pouring in. Feels like progress, right? But churn in SaaS is a hole in the bottom of that bucket. It doesn’t matter how fast you pour new water in; a steady leak means you can never really fill it up. This “leaky bucket” analogy is the perfect way to understand why churn is so destructive.

If you’re constantly losing existing customers, acquiring new ones becomes an expensive, uphill battle. Your sales and marketing teams end up on a treadmill, working tirelessly just to replace lost revenue instead of fuelling actual growth. High churn rates chew away at your Monthly Recurring Revenue (MRR), deflate your team’s morale, and send your Customer Acquisition Cost (CAC) through the roof.

The Foundation of a Healthy Business

Getting a handle on churn isn’t just about playing defence—it’s the bedrock of a healthy, scalable subscription business. When you successfully bring churn down, a few critical things happen:

- Increased Customer Lifetime Value (LTV): Customers stick around longer, which means they generate more revenue over their entire relationship with your company.

- Improved Profitability: It costs a lot more to win a new customer than to keep an existing one. Lower churn is a direct boost to your bottom line.

- Sustainable Growth: With a stable customer base, every new sign-up contributes to net growth, not just damage control.

“Churn is a symptom, not the disease. It’s the ultimate indicator of whether you are delivering on your promise to customers. Ignoring it means you’re not just losing revenue; you’re losing touch with your market.”

Think of this guide as your toolkit for finding the leaks in your own bucket. We’ll walk through how to measure churn accurately, dig into its root causes, and give you actionable strategies to start patching the holes. For a deeper look at the fundamentals, check out this comprehensive guide on churn in SaaS. By making customer retention your most powerful growth engine, you can finally stop leaking revenue and start building a truly resilient business.

How to Accurately Measure Your Churn Rate

You can’t fix what you don’t measure. Before you can tackle churn, you need to get a proper grip on it. Simply knowing that customers are leaving isn’t enough—you need to understand the what, the when, and just how much damage it’s causing.

Think of it like being a doctor. When a patient feels unwell, you don’t just say, “You’re sick.” You take specific measurements—temperature, blood pressure, heart rate—to diagnose the real issue. We need to do the same thing to understand the health of our customer base.

This is the classic “leaky bucket” problem that every SaaS business faces. You’re pouring new customers in the top, but others are slipping out through cracks in the bottom.

It doesn’t matter how great your acquisition efforts are. If you have a significant leak, you’ll never achieve sustainable growth. To plug the holes, you first have to find them.

Customer Churn: The Headcount Metric

The most straightforward place to start is Customer Churn. This tells you the percentage of customers who cancelled their subscriptions over a given period. It’s a simple headcount of lost logos.

The formula is pretty direct: (Customers Lost During Period / Total Customers at Start of Period) x 100 = Customer Churn Rate

Let’s imagine a SaaS company called “SyncUp,” which makes project management software.

- SyncUp kicks off March with 1,000 customers.

- During the month, 50 customers decide to cancel.

- The calculation is: (50 / 1,000) x 100 = 5%

So, SyncUp’s customer churn for March is 5%. This number gives you a vital baseline, but it has a massive blind spot: it treats every single customer as if they’re equal. And we all know that’s rarely the case.

MRR Churn: The Revenue Story

This brings us to a much more revealing metric: Monthly Recurring Revenue (MRR) Churn. Instead of counting logos, this metric measures the percentage of revenue you lost from those cancelled subscriptions. It answers the one question that really matters: “How much money did we actually lose?”

The formula is similar, but it focuses on the cash: (MRR Lost During Period / Total MRR at Start of Period) x 100 = MRR Churn Rate

Let’s check back in with SyncUp.

- SyncUp started March with $100,000 in MRR.

- Those 50 customers who churned were a mix of small teams and one massive enterprise client.

- The total MRR lost from these cancellations was $15,000.

- The calculation is: ($15,000 / $100,000) x 100 = 15%

SyncUp’s MRR Churn is 15%—a figure three times higher than its Customer Churn. Now that tells a much more alarming story. The company isn’t just losing customers; it’s losing its most valuable ones.

This is the kind of insight that should set off alarm bells. A 5% customer churn might seem manageable, but a 15% revenue churn signals a serious fire that needs putting out immediately.

Here’s a quick breakdown to help you keep these two metrics straight:

Comparing Customer Churn and MRR Churn

| Metric | What It Measures | Business Insight | When to Use It |

|---|---|---|---|

| Customer Churn | The percentage of customers lost (headcount). | Reveals the overall “stickiness” of your product. High rates might mean a poor product-market fit or widespread issues. | For a high-level view of customer retention and to track the overall health of your user base. |

| MRR Churn | The percentage of recurring revenue lost from churned customers. | Highlights the financial impact of churn and tells you if you’re losing high-value or low-value customers. | To understand the financial health of the business and to prioritise retention efforts on your most valuable segments. |

While both are useful, MRR Churn almost always gives you the more actionable financial picture. It forces you to pay attention to the customers who are truly driving your business forward.

Cohort Analysis: Pinpointing the “Why”

To dig even deeper, you need cohort analysis. This just means grouping customers who signed up around the same time (e.g., the “January 2024 Cohort”) and tracking how they behave over their entire lifecycle.

By looking at cohorts, SyncUp might discover that:

- 60% of their churn happens within the first 90 days, which points directly to a broken onboarding process.

- One specific cohort churned like crazy right after a major feature was removed.

- Customers who came from a particular marketing campaign have a much higher churn rate than others.

This is how you move from knowing what your churn rate is to truly understanding why it’s happening. These numbers tell a story, but they don’t tell the whole story. To connect the dots, you need to pair this quantitative data with qualitative feedback from surveys. Digging into different survey types, like those we cover in our guide to CSAT and NPS, will give you the context needed to finally act on these numbers.

Finding the Root Causes of Customer Churn

Knowing your churn rate is like getting a fever reading. It tells you something’s wrong, but it doesn’t tell you why. Churn in SaaS is always a symptom, never the disease itself. To find a cure, you have to put on your detective hat and trace the problem back to its source.

Simply knowing that 5% of your customers left last month isn’t an actionable insight. Was it a clunky onboarding process? Did a competitor just drop a killer new feature? Maybe your pricing just doesn’t feel right for the value you provide. Answering these questions is the only way to stop reacting to churn and start proactively preventing it.

Let’s dig into the usual suspects.

A Flawed Onboarding Experience

The first few days with your product are make-or-break. This is when a new customer decides if your software is worth their time and effort. A confusing, unguided, or downright frustrating onboarding experience is one of the fastest ways to lose someone before they’ve even really started.

If you see a big spike in churn within the first 30-90 days, your onboarding is almost certainly the culprit. Customers who never reach that “aha!” moment—the point where they truly get the value of your product—will disengage and cancel. It’s that simple.

To investigate, ask yourself a few honest questions:

- Do we offer a clear, guided path for new users?

- Are we showing off our most impactful features first?

- Is there an obvious spot where people get stuck or just give up during setup?

A Mismatch in Product-Market Fit

Sometimes, the problem isn’t a single feature but a fundamental disconnect between what your product does and what your customers actually need. This is a classic product-market fit problem. You might be attracting the wrong crowd with your marketing, or maybe your product has evolved away from the core problems your ideal user faces.

This cause of churn is sneaky but deadly. Customers in this boat often leave quietly, without a single complaint, because they’ve simply realised your tool wasn’t built for them in the first place.

A tell-tale sign of poor product-market fit is low feature adoption across the board. If most of your users are only touching one or two features, it’s a huge red flag that the rest of the product isn’t solving a real problem for them.

Analysing user behaviour is your key here. If you see that a churned group of customers consistently ignored your core features, it points straight to a value gap. They signed up for a promise your product couldn’t keep for their specific needs.

Frustrating Customer Support

When a customer hits a snag, your support team is their lifeline. A slow, unhelpful, or hard-to-reach support experience can escalate a minor product hiccup into a full-blown reason to cancel. In fact, research consistently shows that poor customer service is a top driver of voluntary churn.

Think of it this way: every support ticket is a moment of truth. A great interaction builds loyalty and reinforces their decision to choose you. A bad one plants a seed of doubt that can quickly grow into a desire to see what else is out there.

Dig into the support metrics for accounts that have churned. Did they have a stack of unresolved tickets? Was their average response time way higher than everyone else’s? The data often tells a pretty clear story. To get the full picture, using dedicated voice of the customer software helps centralise and make sense of feedback from all your touchpoints.

Pricing That Doesn’t Align With Value

Finally, the price has to make sense for the perceived value. Churn can spike if customers feel they’re paying too much for what they get, especially if a competitor offers a similar solution for less. This isn’t just about being the cheapest; it’s about justifying your cost.

A sudden price hike without a matching jump in value is a classic churn trigger. The same goes for an unreliable or buggy product—customers will quickly start wondering why they’re paying for a service that doesn’t work as advertised. Make a habit of reviewing your pricing tiers to ensure they clearly map to the value and features you deliver.

What Is a Good SaaS Churn Rate Benchmark?

So, what’s a “good” churn rate? If you’re looking for a single magic number, I have to break it to you: it doesn’t exist. Context is everything. A 5% monthly churn might be totally fine for a low-cost tool aimed at small businesses, but it would be a full-blown, five-alarm fire for an enterprise SaaS company.

The right benchmark depends entirely on who you’re selling to and how much they pay.

Think of it like a car’s fuel efficiency. You wouldn’t call a sports car that gets 15 miles per gallon “bad”—it’s built for performance, not economy. But if a little compact car got the same mileage? You’d know something was seriously wrong under the bonnet. Your churn rate works the same way; you have to compare it to similar models to get a true sense of how you’re doing.

Segmenting Your Benchmarks

The most important factor in figuring out your benchmark is your customer segment. Different customers have completely different expectations, budgets, and reasons to stick around.

- Small and Medium-Sized Businesses (SMBs): These folks are often more price-sensitive and have fewer resources, which usually means higher churn. A monthly churn rate of 3-7% is pretty common here.

- Mid-Market Companies: With bigger budgets and more complex needs, these customers tend to be stickier. A good monthly churn rate sits in the 1-2% range.

- Enterprise Clients: We’re talking large organisations with long-term contracts and sky-high switching costs. An ideal monthly churn rate here is less than 1%.

To help you see where you stand, here’s a quick breakdown of typical monthly churn rates.

Typical Monthly SaaS Churn Rates by Customer Segment

| Customer Segment | Acceptable Monthly Churn | Ideal Monthly Churn |

|---|---|---|

| SMBs | 3-7% | < 3% |

| Mid-Market | 1-2% | < 1% |

| Enterprise | < 1% | < 0.5% |

This table gives you a solid starting point for benchmarking your own churn against industry norms.

Data from the Southeast Asian SaaS market paints a similar picture. SMBs with a low average revenue per account (ARPA) see monthly gross churn hover around 8.2%, while mid-market is much healthier at 2.4%. As expected, enterprise churn is even lower, around 1% monthly. You can dive deeper into regional SaaS metric benchmarks to see how these numbers shift around the world.

The Ultimate Goal: Net Negative Churn

While plugging leaks is crucial, the real ambition for any subscription business is to achieve net negative churn. This is the holy grail of SaaS. It’s that magical point where the revenue you gain from existing customers—through upgrades, expansions, and add-ons—is greater than the revenue you lose from customers who cancel.

Net negative churn means your business grows even if you don’t sign up a single new customer. Your existing customer base becomes its own powerful, self-sustaining growth engine.

Imagine your monthly recurring revenue (MRR) from existing customers grows by 5% through upgrades, but your MRR churn is only 3%. Your net MRR churn is -2%. Your company is literally growing from the inside out.

Hitting this milestone shows you have incredible product value and rock-solid customer relationships. It signals a remarkably healthy, scalable business and turns churn from a leaky bucket into a genuine opportunity for growth.

Actionable Playbooks to Proactively Reduce Churn

Knowing why customers churn is half the battle. Actually stopping them from leaving? That’s where the real work begins. Moving from diagnosis to action requires a structured approach, not just a bunch of disconnected tactics thrown at the wall to see what sticks.

Instead of guessing what might work, you can implement proven playbooks designed to tackle the most common reasons customers walk away. These strategies are all about building resilience into your customer lifecycle, creating value early, and turning customer feedback into your secret weapon for improvement.

Let’s break down three effective playbooks you can put into action right away.

Playbook 1: Nailing the First 30 Days

The first month is make-or-break. This initial onboarding period is the most vulnerable time for churn in SaaS, and a confusing or underwhelming first experience is a one-way ticket to an early cancellation. This playbook is all about guiding new users to that “aha!” moment as quickly and smoothly as possible.

A successful first month turns uncertain newcomers into engaged fans. The goal is simple: make your product an indispensable part of their workflow within this critical window. Companies that get this right see a massive lift in retention.

Here’s a quick checklist to craft a killer onboarding experience:

- Welcome Email Series: Don’t just send a single “welcome” email and call it a day. Create a drip campaign that walks users through key setup steps and highlights core features over the first week.

- In-App Guided Tours: Use interactive walkthroughs to show users exactly how to accomplish their first major task. Forget showing them everything at once; focus on delivering one key win.

- Proactive Check-Ins: Have a customer success manager reach out around day 7 and day 21. A quick, personalised email to answer questions can make all the difference.

- First Win Milestone: Define a key action that delivers that first taste of value (like creating their first report or inviting a teammate). Track how many users hit this milestone and relentlessly optimise your onboarding to get that number up.

Playbook 2: Creating a Proactive Customer Health Score

Waiting for a customer to complain or cancel is a reactive strategy, and reactive strategies fail. A Customer Health Score is your early-warning system for potential churn, flagging at-risk accounts long before they even think about leaving.

This score rolls up various data points—like product usage and support history—into a single, easy-to-understand metric. Think of it as a simple red, yellow, or green light that tells your customer success team exactly where to focus their energy. To get ahead of the curve, many teams adopt advanced analytics like Top Predictive Modeling Techniques to forecast churn before it even happens.

By monitoring engagement, support history, and product usage, you can predict which customers are drifting away and intervene with targeted support or training before it’s too late.

Key ingredients for a solid health score:

- Product Usage Frequency: How often are they logging in? Are we talking daily, weekly, or “did they forget their password?”

- Feature Adoption Depth: Are they exploring the full power of your product, or just scratching the surface with one basic feature?

- Support Ticket Volume: A sudden spike in support tickets often signals growing frustration.

- NPS/CSAT Scores: Direct feedback from surveys is a goldmine for gauging overall satisfaction.

Playbook 3: Systematising Customer Feedback

Your customers are constantly telling you how to make your product better. The real challenge is actually listening. This playbook is about building a reliable, systematic loop for collecting, analysing, and—most importantly—acting on what they tell you.

A proper system ensures that feedback from surveys, support tickets, and reviews doesn’t just vanish into a black hole. It creates a direct pipeline from customer pain points straight to your development backlog. Closing this loop shows customers you’re listening, which builds incredible loyalty and helps you fix the root causes of churn. It’s a cornerstone of any real retention strategy, a topic we dive into deeper in our guide on customer success for SaaS.

Here’s how to build your feedback loop:

- Centralise All Feedback: Use a tool to pull every piece of feedback from every channel (surveys, emails, support chats) into one organised place.

- Tag and Categorise: Tag feedback by theme—like “UI bug,” “feature request,” or “billing issue”—to spot trends before they become major problems.

- Prioritise and Escalate: Create clear rules for escalating urgent issues and a framework for prioritising feature requests based on customer impact.

- Close the Loop: This is the magic step. When you ship a feature or fix a bug someone reported, reach out and let them know. This simple act has a massive impact on keeping that customer for life.

Building a Product That Resists Churn

While all those proactive playbooks are great, the single most powerful way to slash churn in SaaS is to build a product your customers can’t imagine their workday without. This is about moving beyond just fixing what’s broken and putting customer feedback right at the heart of your product development cycle. The mission? Make your product stickier and more valuable with every single release.

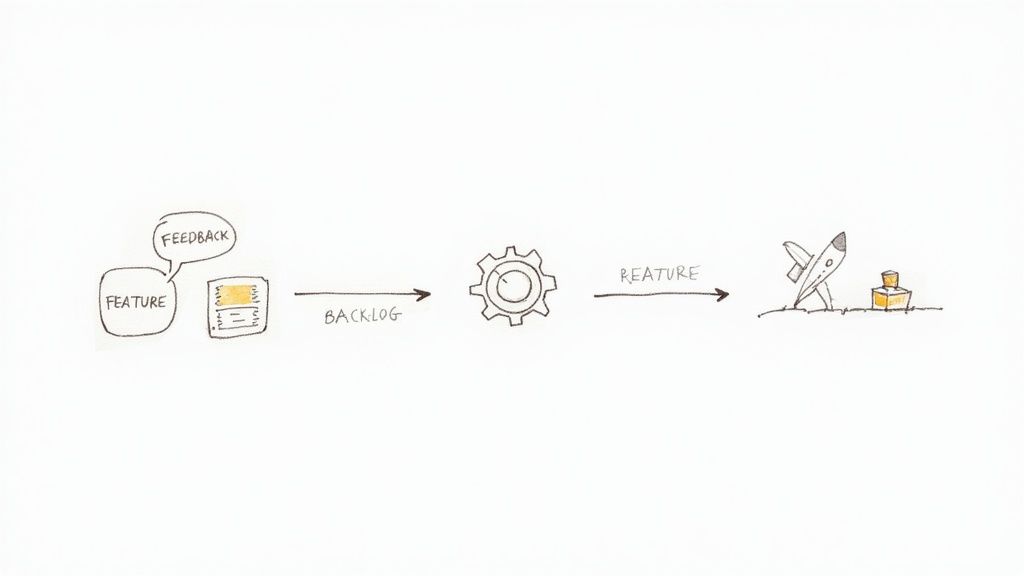

This isn’t about sending out a survey every six months and calling it a day. We’re talking about building a systematic ‘feedback-to-feature’ pipeline. This process takes all that messy, qualitative customer gold—from support tickets, reviews, and feedback forms—and turns it into hard data that directly shapes your development backlog. It’s how you ensure your product roadmap is a direct reflection of what your customers actually need.

Creating a Closed-Loop System

A closed-loop feedback system is where the magic really happens. It’s a process that guarantees customer insights aren’t just collected and forgotten in a spreadsheet somewhere. Instead, they’re analysed, acted upon, and—crucially—followed up on. This creates a powerful cycle where your product evolves in perfect sync with user expectations, making it naturally resistant to churn.

A solid system usually boils down to a few key steps:

- Centralise Feedback: Pull all your customer feedback from every channel—support chats, NPS surveys, in-app widgets—into one single source of truth.

- Quantify and Prioritise: Start tagging and categorising feedback by theme. Think “UI improvement,” “bug report,” or “integration request.” This quickly shows you recurring pain points and the most popular feature ideas.

- Integrate into Your Workflow: Pipe this prioritised feedback straight into the tools your dev team already lives in, like Jira or Linear. Now, customer requests sit right alongside your team’s existing tasks.

- Close the Loop: This is the part everyone forgets. When a requested feature goes live or a bug gets squashed, let the customers who reported it know. Seriously. It’s huge.

This workflow from HappyPanda shows just how neatly feedback can be woven into a product team’s existing toolkit.

The key takeaway here is the seamless journey from raw customer comment to an actionable ticket for your developers. Nothing falls through the cracks.

By systematically turning customer voices into product improvements, you’re not just fixing problems; you’re building loyalty. Customers who see their feedback acted upon feel heard and valued, making them significantly less likely to churn.

This approach transforms your product from a static tool into a living, breathing solution that constantly adapts to solve real-world problems. It becomes an indispensable part of your users’ lives, and that’s the ultimate churn buster.

Got Questions About SaaS Churn? We’ve Got Answers.

Even when you’ve got the basics down, a few tricky questions always seem to pop up when you’re wrestling with churn. Let’s clear the air with some straight answers to the most common ones, so you can stop wondering and start acting.

What’s the Difference Between Voluntary and Involuntary Churn?

Getting this right is a game-changer because you tackle each one completely differently.

Voluntary churn is when a customer makes a conscious choice to leave. They hit the cancel button because they weren’t happy, found a better tool, or their business needs changed. It’s personal.

Involuntary churn, on the other hand, is purely accidental. The subscription ends because of a technical hiccup, usually a failed payment. Think expired credit cards or insufficient funds. While both mean lost revenue, involuntary churn is way easier to fix with things like automated payment reminders and dunning tools.

Tackling involuntary churn is the definition of low-hanging fruit. It’s a technical problem with a technical solution, letting you claw back revenue that was slipping away for no good reason.

How Does a Customer Success Team Actually Reduce Churn?

Think of your customer success team as your front-line defence against churn. Their whole job is to make sure customers are winning with your product.

Instead of sitting back and waiting for a support ticket, a Customer Success Manager (CSM) is out there preventing problems before they even start. They have a massive impact on reducing churn in saas by:

- Nailing the onboarding so users see value right away.

- Keeping an eye on customer health scores to spot wobbly accounts before they go quiet.

- Building real relationships that create loyalty and keep communication lines open.

Unlike reactive support, which is all about fixing what’s broken, customer success is about proactively making sure customers get so much value they can’t imagine leaving.

What Is the Very First Thing My Company Should Do to Reduce Churn?

Before you dream up a massive, complex strategy, do two things first: measure your churn accurately and talk to your customers. You need a starting line and a direct connection to the “why.”

Kick things off by calculating both your customer and MRR churn rates. This gives you an honest, unfiltered look at where you stand. At the exact same time, start sending exit surveys or, even better, hopping on quick calls with people who just cancelled. You need to hear their reasons in their own words.

This initial data is pure gold. It ensures you’re pouring your energy into solving the real problems from day one, instead of just guessing what might be broken.

Ready to stop guessing what your customers think? HappyPanda gives you the tools to collect, analyse, and act on user feedback directly within your app. Turn customer insights into your most powerful tool against churn. Start building a product that resists churn by visiting https://happypanda.ai today.